How Cautious Beauty Investors Are Evaluating Brands Today

Beauty M&A is expected to increase this year, but that doesn’t mean investors and strategic buyers will become less choosy with their targets, according to dealmakers involved in the industry.

“Desirable brands that are growing and profitable will still get acquired, but brands that may have a few more blemishes that maybe would’ve been overlooked in 2022 are simply not going to trade,” said Christina Yu, principal at NextWorld Evergreen, the private equity firm with Credo and True Botanicals in its portfolio, during a recent Beauty Independent In Conversation webinar where she was joined by Rich Gersten, co-founder and managing partner at True Beauty Ventures, and Susan Lin, partner at Felix Capital.

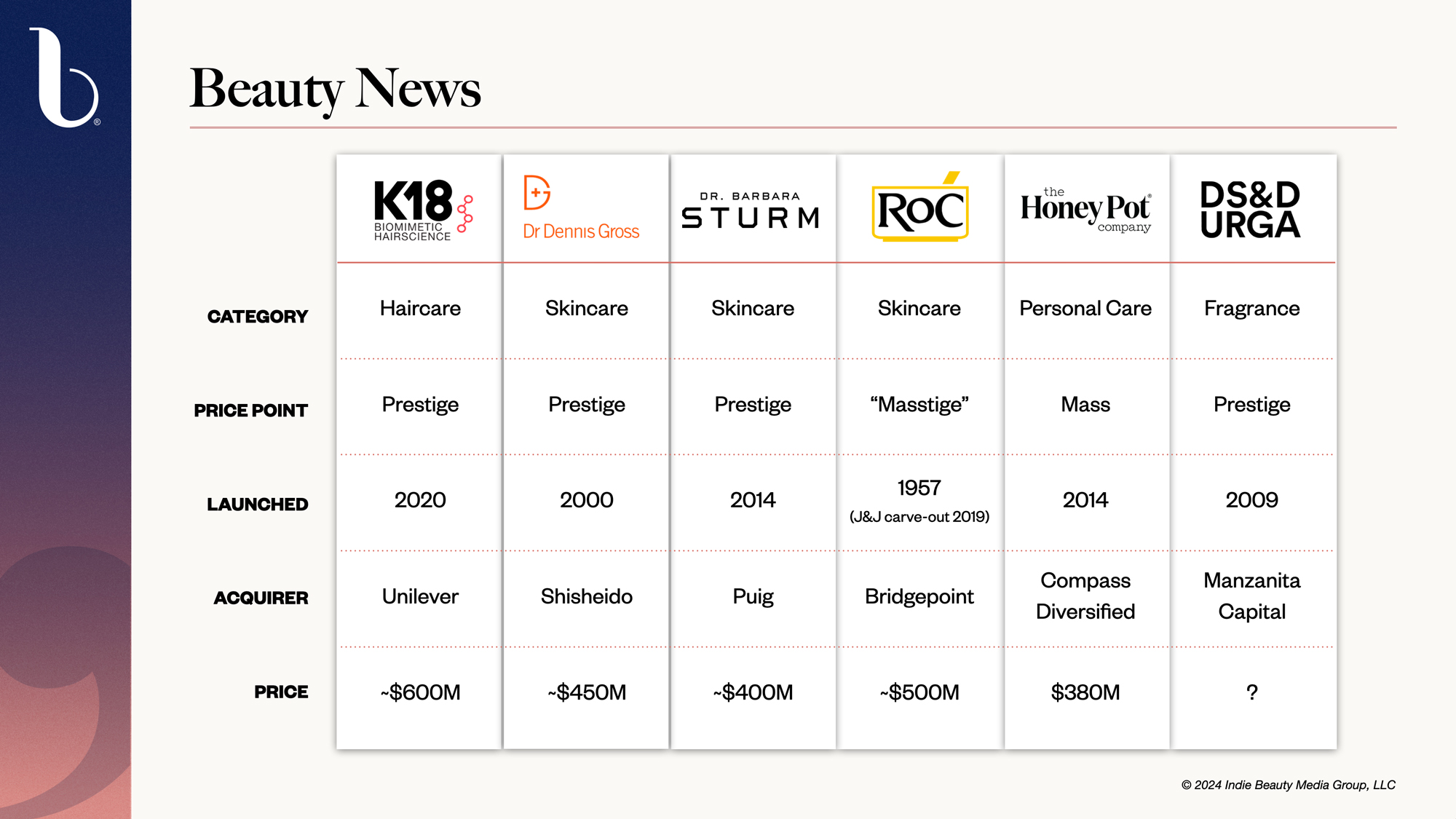

Beauty M&A was down in 2023, a year that saw venture capital funding fall to a 6-year low. Still, it wasn’t a total wash. Procter & Gamble, Kering, E.l.f. Beauty, Unilever, Shiseido and Puig scooped up Mielle Organics, Creed, Naturium, K18, Dr. Dennis Gross Skincare and Dr. Barbara Sturm, respectively. This year, RoC Skincare, The Honey Pot Company and D.S. & Durga have already traded.

Yu emphasized that recent beauty M&A activity demonstrates the importance of beauty companies creating differentiated products that yield brand loyalty. In a crowded market, consumers are gravitating toward doctor-backed and science-based brands with distinct technologies—and investors are taking note.

Yu said, “We’re always looking for what is truly proprietary about a brand’s products because, at the end of the day, that’s part of the competitive moat that a brand brings to the table.”

She elaborated that robust repeat purchase rates and positive earnings before interest, taxes, depreciation and amortization (EBITDA) margins are also top of mind when NextWorld Evergreen vets brands. With a focus on high-growth assets, the firm’s smallest checks generally clock in at $10 million.

Energized by deal activity at the outset of 2024, Gersten underscored that strategic acquirers are jumping into every beauty category. “It doesn’t matter what category it is, it’s fragrance, it’s personal care, it’s skincare, it’s haircare,” he said. “It doesn’t matter what distribution channel it is, it’s prestige, masstige. It tells me that strategics are active, that private equity firms are active, and that family offices are active, and it tells me, if you get in early, the valuations paid for these brands are quite strong.”

Lin noted that brand exits often follow two trajectories: They’re fueled by proprietary technology and explosive growth or years of fostering community and brand equity. She singled out K18, the bond-building haircare brand, as an example of the former path.

True Beauty Ventures invested in K18. Lin and Gersten mentioned that K18’s narrow distribution concentrated in the United States made it attractive to strategic buyers interested in expanding the brand beyond North America. The brand is available at salons, Sephora and Amazon.

Lin said, “With K18, you have exceptional technology and results and efficacy, but in other categories where the product may be slightly less differentiated because it’s facing a more crowded field like in skincare or fragrance, I think it takes time to build up that brand equity and community.”

Retail Dynamics

Similar to brands, retailers are grappling with elevated costs, fierce competition and cautious consumers. Faced with continuous pressure on top- and bottom-line growth, many retailers are shuttering their doors or struggling to stay afloat as they scramble for funding. Meanwhile, larger players are consolidating.

Gersten noted that investors are drawn to retailers with healthy margins and unit economics. However, the amount of capital needed to fuel significant store rollouts can be a deterrent compared to investing in a single brand’s growth. “It’s an out of favor industry from a return on capital investment perspective,” says Gersten. “With brands, it’s much easier to see the path forward to a strong return.”

On the brand side, retail is a key aspect in True Beauty Ventures’ screening of potential assets. Brands that make it into its portfolio, including Caliray, Dieux, 7 Virtues and Youthforia, typically secure distribution with a major specialty beauty retailer like Sephora and Ulta Beauty. The early-stage beauty and wellness investment firm usually writes checks between $1 million and $5 million.

Yu pointed out that a smaller retailer must operate within a unique niche to thrive in the contemporary retail landscape and stand out to investors. Retailers competing solely on price often falter and head down what she referred to as a “debt spiral.” Yu said, “You have to give your customer a compelling reason to shop with you and then that will help build your unit economics, which is the building blocks of getting to scale without raising a crap ton of money.”

Lin mentioned that e-commerce concepts face an enormous amount of pressure from Amazon and rival marketplaces as well as big brick-and-mortar chains and brands’ websites. Online beauty retailers in particular are challenged in a category that remains driven by purchases in physical locations.

Lin said, “This is a category where the winning channel is omnichannel, so having only that online platform itself, it doesn’t work to reach a broad enough audience and to make the unit economics work.”

As it reviews brands, Felix Capital, which formerly invested in beleaguered luxury e-commerce platform Farfetch, hunts for compelling founder stories and consumer products. It backs early-stage and growth companies, with check sizes ranging between $2 million to $3 million and $10 million to $30 million.

Brand Evaluations

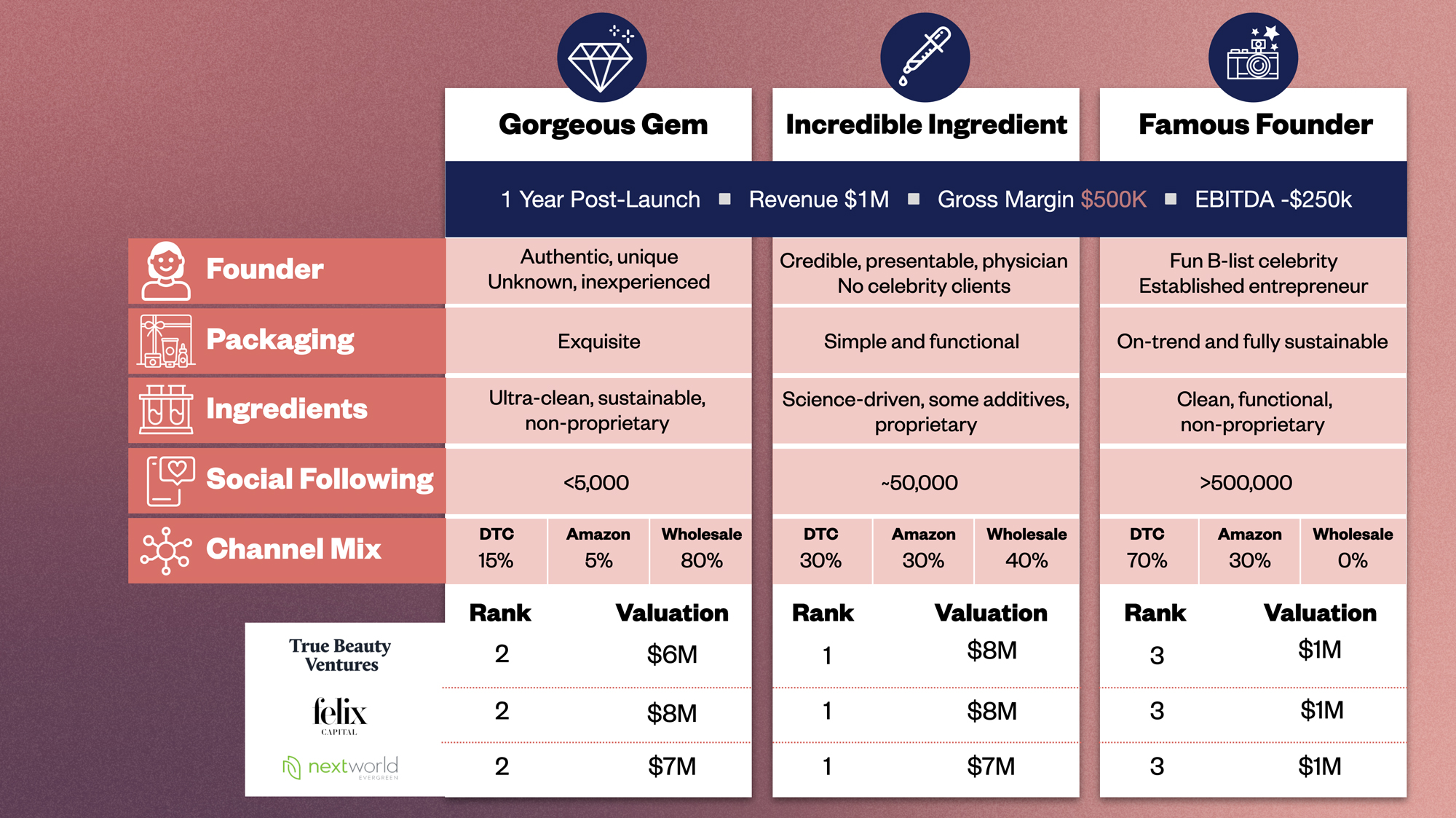

During the webinar, Gersten, Lin and Yu participated in an exercise in which they assessed, ranked and estimated valuations for hypothetical brands named “Gorgeous Gem,” “Incredible Ingredient” and “Famous Founder” for their most coveted attribute, although they each have other attributes, too. For instance, Incredible Ingredient has a diversified distribution network across DTC, Amazon and wholesale outlets. A year after their launches, the fictitious brands generated $1 million in revenues and EBITDA of $250,000.

The investors all ranked Incredible Ingredient first, Gorgeous Gem second and Famous founder third, but they placed divergent valuations on the brands. Below are details on those valuations and a bit about the investors’ thought processes:

Gersten: $8 million valuation for Incredible Ingredient, $6 million valuation for Gorgeous Gem, and $1 million valuation for Famous Founder. Speaking of Incredible Ingredient, he said, “A lot of what we talked about—clinical, very science driven—is very important, at least in today’s market. It has a good omnichannel strategy and has proven the ability to be in wholesale and direct-to-consumer. It has a credible founder and an authentic founder story, which definitely matters to us.”

Lin:$8 million valuation for Incredible Ingredient, $8 million valuation for Gorgeous Gem, and $1 million valuation for Famous Founder. Discussing Famous Founder, she said, “It’s quite telling that, despite having a famous founder, they only did $1 million in their first year post-launch. By contrast, Gorgeous Gem, who had zero contacts in the industry, had the same traction. It’s likely that Famous Founder is not very well executed.”

Yu: $7 million valuation for Incredible Ingredient, $7 million valuation for Gorgeous Gem, and $1 million valuation for Famous Founder. Talking about Gorgeous Gem, she said, “If they’re at 80% wholesale with 50% gross margins, there’s actually some upside there if they were to expand their channel mix.”

Leave a Reply

You must be logged in to post a comment.