McKinsey & Co.: Consumers Expected To Pull Back On Skincare And Makeup Purchases This Year

While inflationary pressures have been easing in the United States, consumers remain cautious with many planning to pull back their beauty purchases this year as they feel the sting of elevated prices, according to market analysts.

According to surveys conducted by global management consultancy McKinsey & Co., among all merchandise categories, including household goods, toys, pet food, vitamins and fitness, makeup and skincare are the categories that rank highest for consumer intent to reduce spending. The leading reason for consumers wanting to spend less on makeup and skincare is a belief that makeup and skincare prices are too high.

Consumer thriftiness was evident in select personal care, beauty and wellness category sales dips in the fourth quarter last year. McKinsey estimates that bath and shower, vitamins and supplements, first aid, haircare and pain relief category sales decreased between 4% and 6% in the quarter compared from the same period the year before. However, there were volume gains in cosmetics, deodorant and nail grooming of between 2% and 3%.

Alexis Wolfer, associate partner at McKinsey, shared the data in a recent Beauty Independent In Conversation webinar. For the webinar, she was joined by Jennifer Famiano, executive director and beauty industry analyst at market research firm Circana, and Ashleigh Barker, director at investment banking advisory firm Lincoln International. According to McKinsey’s data, 30% of consumers surveyed said that they are purchasing fewer nice-to-have beauty and personal care items in favor of daily essentials while 20% said they’re purchasing more private label products in the category. Additionally, consumers purchased fewer beauty units per beauty shopping trips, although their beauty trip frequency increased.

Consumers reported to McKinsey that they stocked up on beauty products during promotional periods. Wolfer said, “There was this notion, particularly when we spoke to this most recent panel of consumers at the end of December, that ‘I reduced because I had purchased previously.’”

Despite consumer caution, Wolfer had an optimistic take on the beauty industry going forward. She predicts areas of growth within the industry will offset struggling areas. She identified science-backed beauty, premium haircare, ultra luxury and niche fragrances, supplements and sexual wellness products as categories of potential hypergrowth.

“We are consistently seeing a bifurcation in the market, and we see this across channel price point, etc., where consumers are mixing their baskets across price tiers,” she said. “They’re pulling back in meaningful ways, but they’re also splurging.”

Category Performance

On the whole, the beauty industry in the United States saw sales advance 11% last year on a dollar basis. The mass market accounted for third-quarters of beauty’s volume, but prestige’s growth outpaced mass in units and dollars sold. Specifically, prestige beauty sales increased 12% in units and 14% in dollars in 2023 to hit $31.7 billion. Mass beauty sales climbed 7% in dollars and registered flat performance in units sold.

Similar to 2022, makeup was prestige’s strongest category performer last year. Makeup sales ticked up 15% to $2.6 billion. Mass makeup sales rose 6%. Famiano noted that makeup performed the strongest during the first quarter of 2023, and brick-and-mortar retail accounted for roughly two-thirds of makeup sales volume. Up 31% last year, the lip category dominated prestige makeup’s growth as hybrid products like tinted lip oils and lip balms accounted for the lion’s share of sales. Sales of lip oil products were 12 times greater last year than in 2020.

“We can probably arguably call 2023 the year of the lip oil,” says Famiano. “This has been largely a social media-driven trend as lip oils really started to take off on TikTok.”

Prestige skincare followed closely behind makeup, outpacing the latter category’s sales in units and dollars sold nearly every month after April 2023. Prestige skincare grew 14% in dollars and 15% in units for the year. Mass skincare sales jumped 11% in dollars and 4% in units. The category had a robust fourth quarter, spiking 15% in dollars and 16% in units. Body care products achieved the greatest momentum. Specifically, sales of body sprays were up 187%.

Serums and creams were the two leading subcategories within prestige facial skincare, and lower-priced clinical brands resonating the most with consumers last year. Within mass skincare, facial moisturizers and cleansers grew double- digit percentages in dollars and units sold.

Famiano underscored that consumers traded up in skincare last year, with body lotion and face serums experiencing the shift the most. She said, “It’s very likely that the consumer is treating herself, and we are seeing a sort of trade up in the areas of skincare where prices between prestige and mass are within that $10 sweet spot.”

Prestige fragrance sales increased 12% and registered double-digit growth nearly every month last year. Famiano mentioned that gen Z fueled the majority of the category’s sales with parfums and eau de parfums advancing the fastest. Prices in the category increased 4% year-over-year and reached an average price of $73. Famiano said, “Keep in mind that much of the price increases that extended into 2023 were a result of consumers trading up to a higher price point concentration.”

Consumers traded up in haircare last year, too, as they prioritized salon brands and hair health products designed for long-term efficacy. Famiano said, “Prestige average prices are just over $24, while mass prices are just under $8. So, what this tells us is we have a consumer that believes she’s paying for a more effective product.”

Prestige haircare increased 14% in dollars and 9% in units last year. Mass haircare grew 6% in dollars, but declined 2% in units. Hair masks, dry shampoos and hairstyling products flew off the shelves. Sales of shampoo and conditioner underperformed.

Deal Activity

After an uncertain 2023 in which venture capital investment fell to a 6-year low, beauty M&A activity is set to accelerate throughout the year as investors and strategics work through their deal pipelines from the past 12 months. Barker predicted that transactions and investments in growth equity would increase, especially in the second half of this year as the Fed cuts interest rates.

“This is going to make access to debt, which is ultimately used to fund a lot of the larger scale transactions, much easier to come by,” she said. “When you have more debt capacity to fund a transaction, it means you’re going to be willing to pay a lot more.”

Barker pointed out that the ecosystem of buyers in the beauty market has become more diverse and competitive, especially in the private equity realm. Private equity firms Bridgepoint and Manzanita Capital acquired RoC Skincare and D.S. & Durga earlier this year, respectively.

Barker said, “There are some people that are super keen on finding that asset in the beauty and personal care space, and they’re going to be willing to pay up, which bodes well for those that are considering a transaction over the course of 2024.”

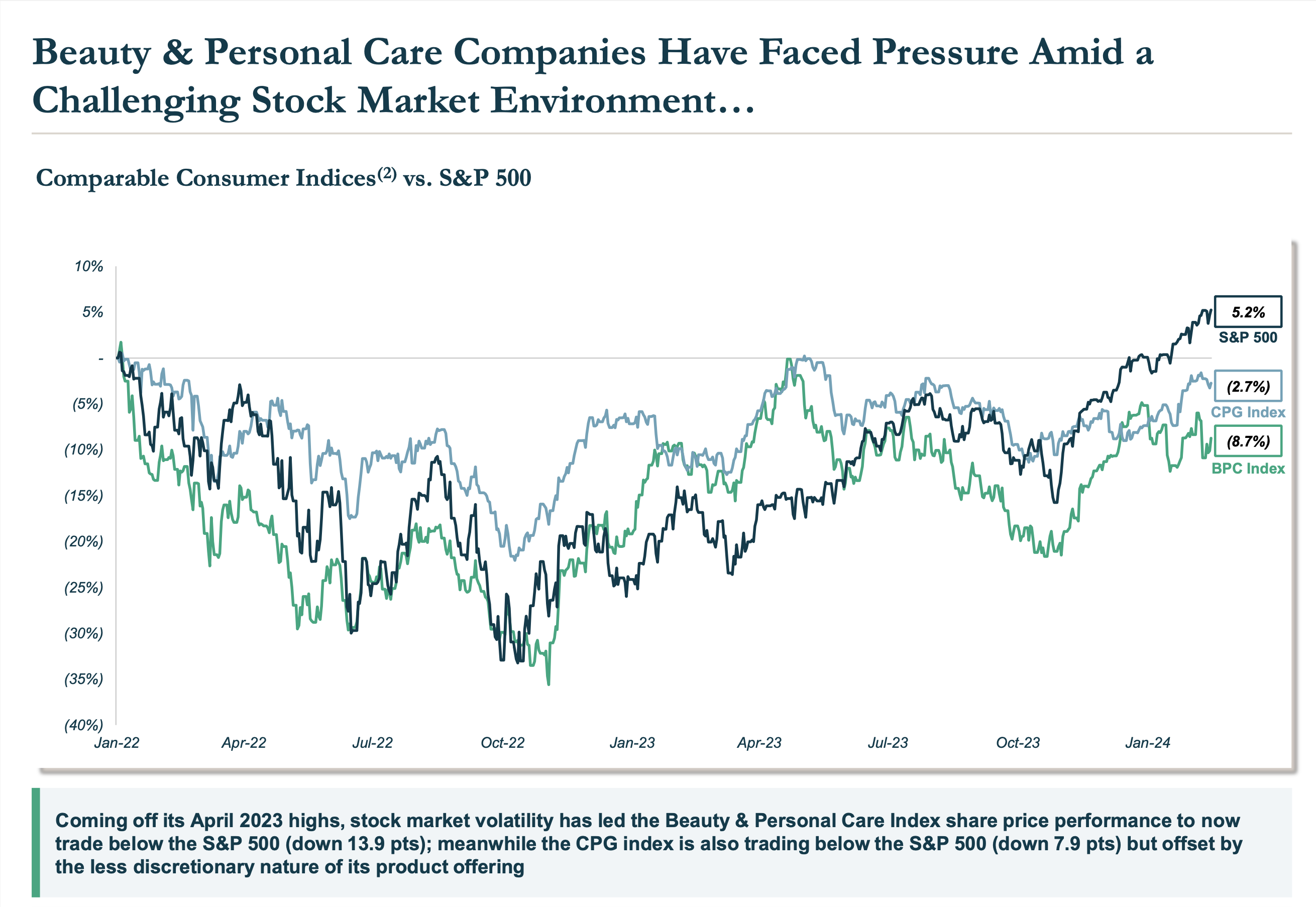

However, beauty conglomerates are coming off a volatile post-pandemic period, and it’s affected their financials. Public beauty and personal care companies are currently trading below the S&P 500 index as are consumer product goods companies in general. Stronger performers like Coty, L’Oréal and E.l.f. Beauty are leaning into their core competencies and delivering on cost savings, while Estée Lauder, Shiseido, Procter & Gamble and Unilever have been weighed down by volume losses, sluggish international markets and the slow return of travel retail abroad.

Barker said, “The state of these public companies and how they’re performing is often how they’re going to be thinking about placing a value on deals that they might be looking at.”

While valuations have been compressed, Barker pointed out they remain above pre-pandemic levels. She stressed that investors and strategic buyers will continue to prioritize profitable, growing companies with differentiation in terms of efficacy and positioning. To separate from laggard assets, Barker forecast that more companies will look to offload poor-performing areas of their portfolios this year.

“2024 will also mark a period of seeing many more divestitures and carveouts,” she said. “Some of the larger platforms are also looking to focus more inward on the key wins that they can really demonstrate growth for and are going to be seeking new partners.”