XRC Ventures Pinpoints The Exact Metrics Investors Want To See From Emerging Beauty Brands Now

The goalposts keep moving up for emerging brands looking to nab early-stage capital.

That’s among the biggest takeaways from a report on consumer venture capital benchmarks for the first quarter of this year by VC firm XRC Ventures that chronicles a shrinking pool of investors backing beauty brands as generalist investors financing startups in several industries retreat from consumer goods and competition between brands in the beauty industry remains fierce. According to XRC Ventures data based on insights from financial information platform Crunchbase, VC funding in the beauty sector crumbled 80% from its peak in 2021 and 50% from 2022 to hit $800 million in 2023, the first year since 2017 it didn’t reach $1 billion, and a dramatic turnaround isn’t projected in the near term.

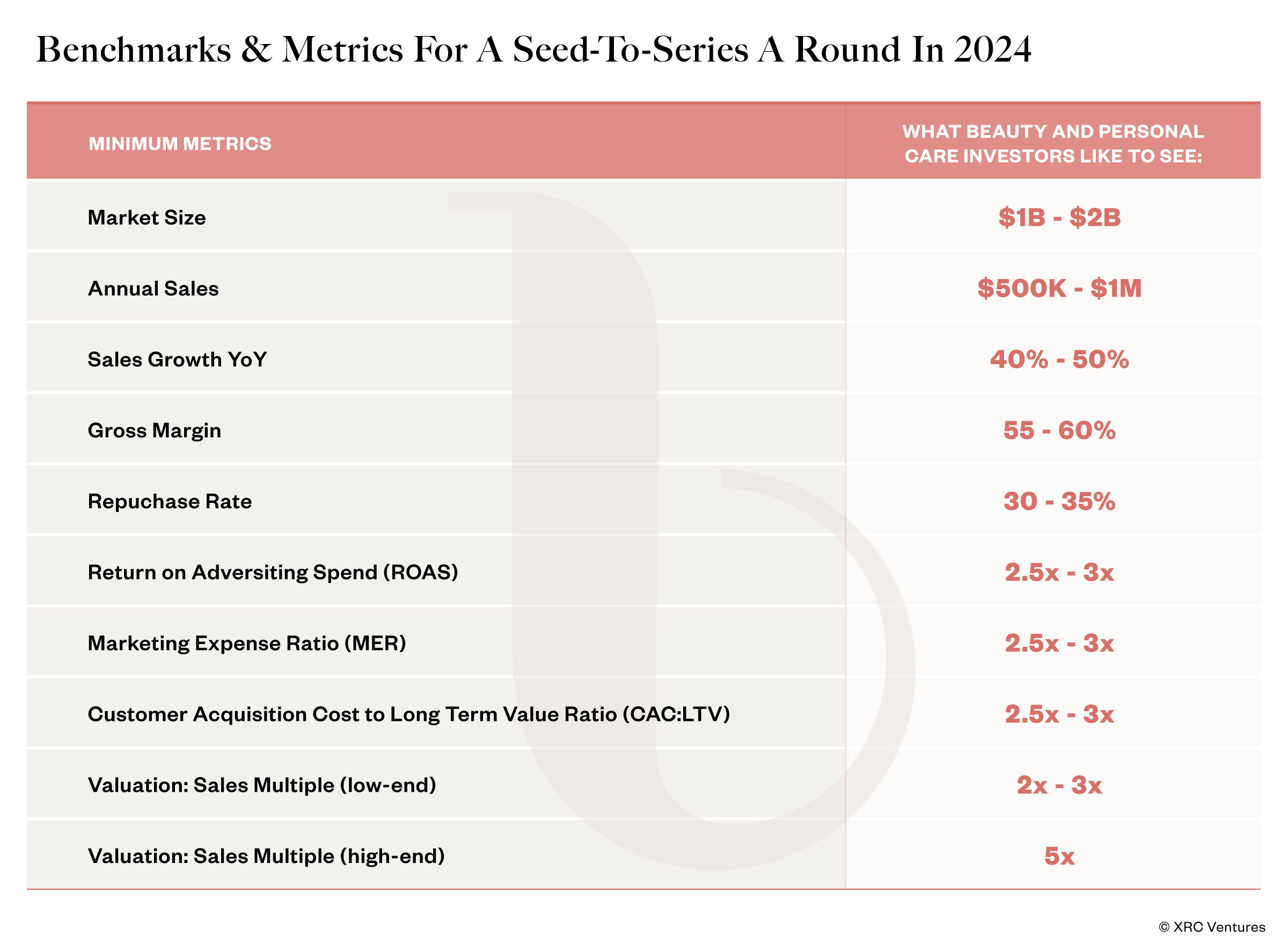

As part of the report, XRC Ventures surveyed 11 beauty investors, including at JamJar Investments, Fab Co-Creation Studio Ventures, Palette and True, who divulged they’re typically holding back from injecting capital into nascent beauty brands unless they’re doubling sales and registering gross margins of at least 55% to 60%, but as much as 70% to 80%, repurchase rates of 30% to 35% and customer acquisition cost to long-term value ratios of 2.5X to 3X. For valuations, sales multiples for early-stage brands are in the range of 2X to 5X, and they’re generally flat across funding stages.

“The hurdle rates in terms of metrics required to get institutional funding are higher than they were five, 10 years ago, so some form of bootstrapping, friends and family rounds or working capital loans like Shopify will be necessary before you even approach institutional investors,” says Diana Melencio, general partner at XRC Ventures’ Brand Capital Fund. “If you hear what investors are saying, they’re saying that they’re willing to invest pre-product, but, if you look at the track records, what you’ll find is that is the exception and not the rule. Unless it’s very IP driven, you’ll very much need to be in market and for some investors you’ll need to be in retail.”

In the report, Joe Seager-Dupuy, director of investment at True, a VC firm with Bleach London, Boy Smells, Haeckels, Maude and Indē Wild in its portfolio, says, “Beauty and personal care has always been a key category for us and will continue to be so into the future. But the bar is high to be a venture-backable business in the space. For us to build conviction, we need to see tangibly differentiated products and technologies that solve real consumer problems, and entrepreneurs with the ambition, drive and perseverance to build a generational company despite a tougher funding climate.”

As generalist investors pull back from consumer goods, Melencio detects a widening gap in the funding landscape for beauty brands generating tens of thousands in revenues up to $500,000 to $1 million. The gap stretches out periods between funding rounds, decreases beauty brand innovation and leads to fewer beauty brands passing $1 million in sales. Brands scrambling for capital amid the early-stage funding squeeze are turning to alternative funding sources such as factoring for those with a retail footprint and crowdfunding.

“You’re going to see less brands as a result of this funding gap. We’re seeing a lot of brands both in beauty and other consumer categories not survive into a seed or series A,” says Melencio. “At the same time, I do think that the best brands will make it.”

While generalist investors are chasing artificial intelligence breakthroughs, investors dedicated to beauty are doubling down on it. In XRC Ventures’ survey, around 80% forecast they’ll invest the same or a greater amount in beauty this year. There are plenty of positive signs for them in the beauty universe. XRC Ventures highlights that beauty deal volume in the second half of 2023 jumped 25% over the first half.

“The hurdle rates in terms of metrics required to get institutional funding are higher than they were five, 10 years ago.”

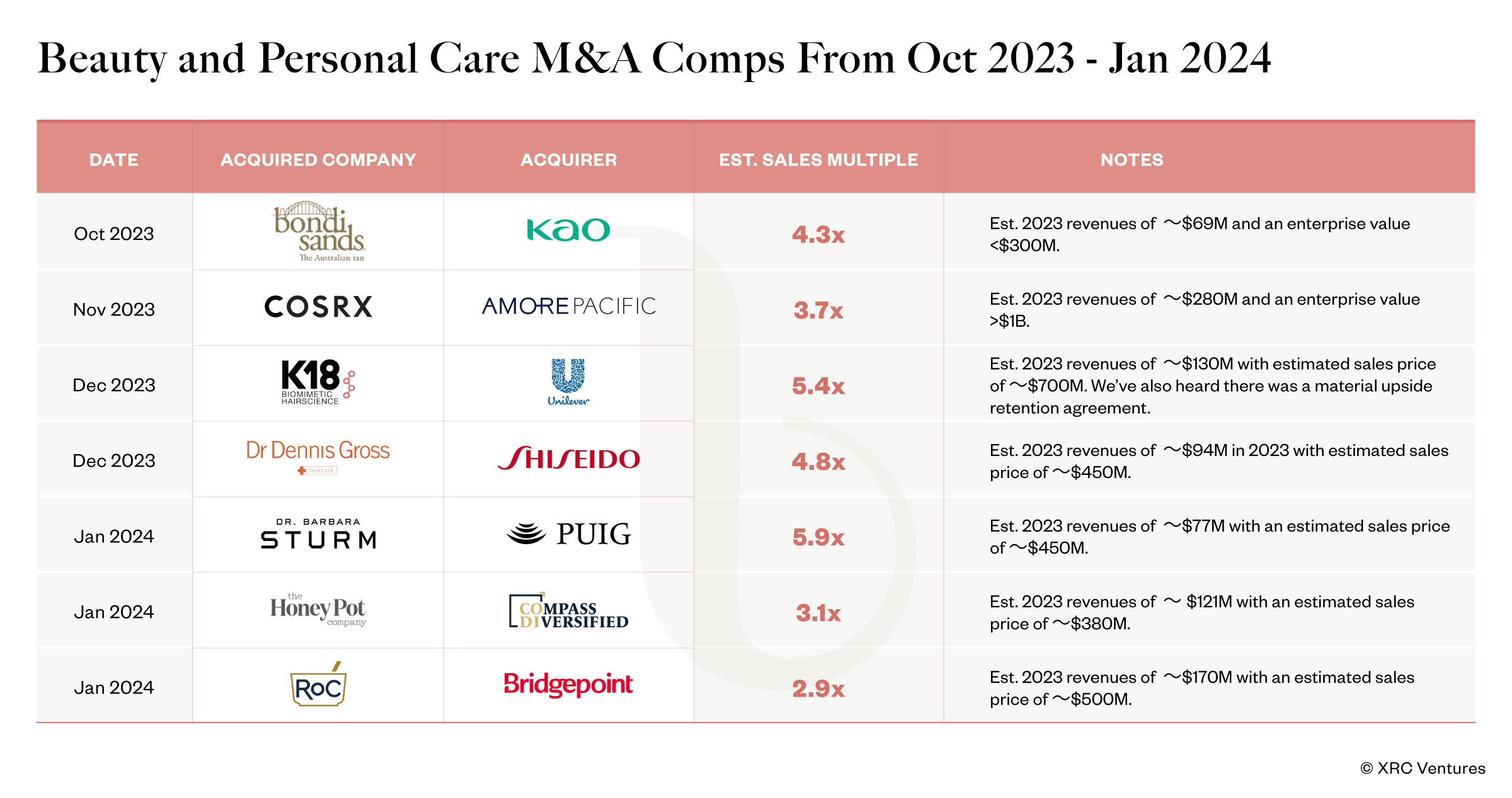

Unilever acquired K18 and Shiseido acquired Dr. Dennis Gross Skincare at the end of last year. At the beginning of this year, Puig acquired Barbara Sturm, Compass Diversified acquired The Honey Pot Company, and Bridgepoint acquired RoC.

XRC Ventures highlights as well that beauty outperformed all other consumer categories in 2023 with double-digit revenue growth and exits that achieved what it describes as “healthy” sales multiples of 3X to 7X. Given the conditions, several notable brands are currently in the marketplace eyeing transactions. Summer Fridays, Westman Atelier, Rare Beauty and Glossier are examples of brands expected to trade soon.

With their involvement in beauty not tailing off, XRC Ventures predicts specialist consumer funds will outperform the market. In addition, it predicts strategics will play a larger role in crowning investor and brand winners. XRC Ventures is one of the VC firms not pivoting away from beauty. Its portfolio contains the beauty brands Minu, Naked Sundays and Solawave.

“My prediction is continued investment in the beauty and personal care category at stable valuations,” says Melencio. “There are a lot of great brands that are going out to market. Rare is one of them, and Summer Fridays is another. I think we’ll see very attractive prices for them, and that’s only going to help bolster the interest in emerging brands.”

Investigating slices of the beauty industry that investors are focusing on, XRC Ventures identifies inside-out/outside-in beauty (think Jolie, Hum Nutrition and Canopy), body care (Nécessaire, Playground and Naked Sundays), effective science-backed beauty (Epres, Vella and The Ordinary), mass premiumization (Bubble, Native and Cocofloss), and at-home beauty treatments relevant to the convergence of wellness and beauty (Solawave, Love Wellness and Bushbalm).

Melencio is particularly bullish on science-backed beauty. “That has to do with the fact that consumers are getting smarter. They’re really demanding efficacy from their products,” she says. “Because I’m an investor and I have to keep return on investment in mind, we’re seeing a lot of the acquirers in the category also really bullish on it, not only in the acquisitions that they’ve made recently, but also in some of the remarks that they’ve made.”

Although it’s anticipated that prominent color cosmetics brands have deals on the horizon, Melencio isn’t overly bullish on the category for budding brands. She says, “You need a breadth of foundation shades in order to be in market for very good reasons so that the brand is inclusive and can serve all consumers, but that SKU proliferation has margin impacts, operational impacts, minimum quantity order impacts, and it’s also much more trend driven and it’s harder to differentiate from a formulation perspective.”